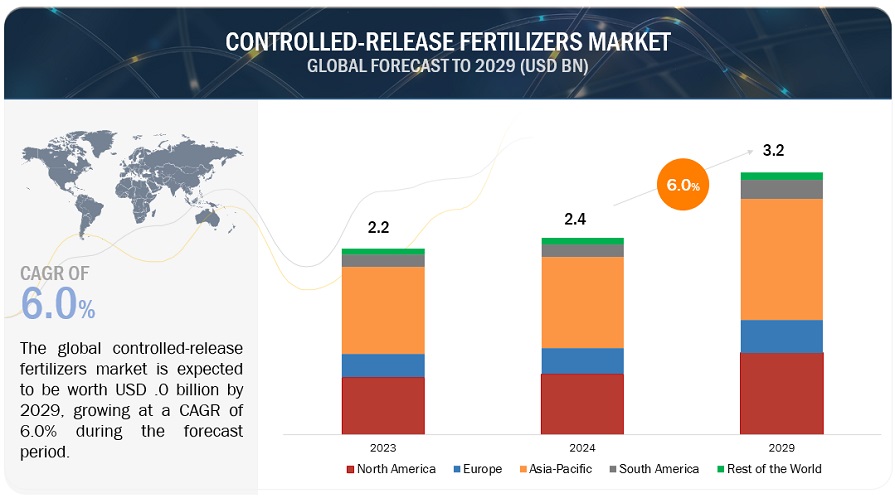

According to a research report "Controlled-release Fertilizers Market by Type (Slow Release, Coated and Encapsulated, Nitrogen Stabilizers), End Use (Agricultural and Non-Agricultural), Mode of Application (Foliar, Fertigation, Soil) and Region - Global Forecast to 2028" published by MarketsandMarkets, the controlled release fertilizers market is estimated at USD 2.2 billion in 2023 and is projected to reach USD 2.9 billion by 2028, at a CAGR of 5.9% from 2023 to 2028. The growing demand for controlled-release fertilizers is primarily fueled by their ability to enhance nutrient efficiency, reduce environmental impact, and align with sustainable agricultural practices, meeting the needs of both farmers and environmental concerns.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=136099624

The slow-release segment is expected to grow at the highest CAGR during the forecast period.

The market for slow-release fertilizers has experienced steady growth due to their inherent benefits in enhancing agricultural sustainability and productivity. The controlled and gradual nutrient release of these fertilizers aligns with precision agriculture techniques, ensuring optimal nutrient uptake by crops and minimizing wastage. This approach has gained traction as farmers seek to improve resource management, reduce nutrient runoff, and comply with stringent environmental regulations. Additionally, the rising awareness of soil health, water quality preservation, and long-term crop viability have driven the adoption of these fertilizers, making them a key component of modern farming strategies aimed at achieving both economic and environmental objectives.

The non-agriculture segment by end use emerged as a driving force in the controlled-release fertilizer market in 2022.

The non-agriculture segment has contributed to the growth of the controlled-release fertilizers market. The urban landscape's growing reliance on controlled-release fertilizers is set to propel the market's expansion. Golf courses, municipal parks, residential complexes, and other non-agricultural areas seek sustainable solutions that controlled-release fertilizers can provide. This dominance aligns with the broader trend of urbanization and the corresponding need for environmentally friendly, efficient, and visually appealing landscaping solutions.

In urban areas, aesthetics and visual appeal hold significant importance. Controlled-release fertilizers contribute to lush and vibrant green spaces that enhance the overall aesthetics of urban environments. Moreover, the slow and controlled nutrient release of these fertilizers results in reduced application frequency, translating to fewer maintenance cycles for landscapers, golf course managers, and homeowners. This efficiency appeals to non-agricultural users seeking to streamline operations.

Request for Sample Pages:

https://www.marketsandmarkets.com/requestsampleNew.asp?id=136099624

Argentina is expected to be the fastest-growing market in the South American region during the forecast period.

Argentina is poised to emerge as the fastest-growing player in the controlled-release fertilizers market within South America. Argentina places considerable emphasis on sustainable farming practices, aligning with global trends and consumer preferences. Controlled-release fertilizers offer a solution to minimize nutrient runoff, reduce environmental impact, and promote soil health, making them a natural fit for the country's sustainable agriculture initiatives.

Argentina's dominance in the South American controlled-release fertilizers market is enhanced by a convergence of favorable conditions. Its strong agricultural foundation, commitment to sustainable practices, emphasis on innovation, and strategic export position create a conducive environment for both the production and adoption of controlled-release fertilizers. This dominance is expected to fuel continued growth in the sector, as Argentina solidifies its role as a key player driving the evolution of agricultural practices in the region.

Major players operating in the controlled-release fertilizers market are Yara (Norway), Nutrien Ltd. (Canada), Mosaic (US), ICL (Israel), Nufarm (Australia), Kingenta (China), ScottsMiracle-Gro (US), Koch Industries (US), Helena Chemicals (US), and SQM (Chile).