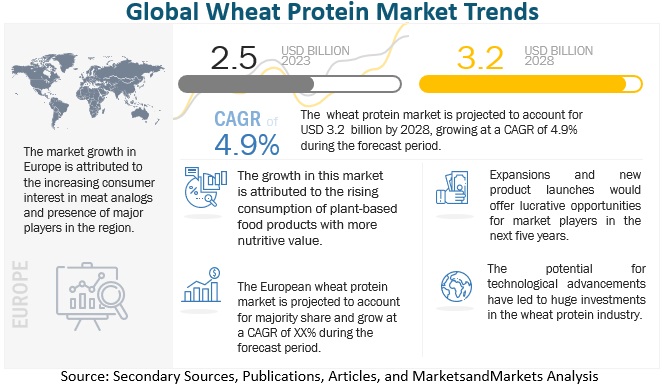

According to a research report "Wheat Protein Market by Product (Gluten, Protein Isolate, Textured Protein, Hydrolyzed Protein), Form, Concentration, Application (Bakery Snacks, Pet Food, Nutritional Bars Drinks, Processed Meat, Meat Analogs) Region - Global Forecast to 2028" published by MarketsandMarkets, the wheat protein market is projected to reach USD 3.2 billion by 2028 from USD 2.5 billion by 2023, at a CAGR of 4.9% during the forecast period in terms of value. The market for wheat protein by concentration is experiencing growth due to the increasing demand for plant-based protein products in food beverages, dietary supplements, and animal feed industries.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=67845768

Wheat Gluten to dominate the market during the forecast period

The functionality of wheat gluten is unique, and its structural integrity is retained after cooking. Also, it appears to have no functional competitor. It is used in a variety of applications, such as bakery products, meat products, pasta, and pet foods. In the bakery, the strength of gluten is a key factor in bread baking. It plays an important role as it contributes to the ability of the dough to rise and maintain texture. China is also a major producer and consumer of wheat gluten.

By concentration, 75% wheat protein concentrate to hold a significant market share during the forecast period

75% concentration wheat protein is generally less expensive than high concentration wheat protein. This makes it a more cost-effective option for some applications where the functional properties of the protein are less critical. Also, a 75% concentration of wheat protein may contain a broader range of nutrients than a high concentration of wheat protein. This can make it a more attractive option for certain food products, such as meal replacement shakes or nutritional supplements. Additionally, a 75% concentration of wheat protein may have a milder taste than a high concentration of wheat protein. This can make it a more desirable option for certain types of food products, particularly those where the protein flavor is more pronounced.

Make an Inquiry @

https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=67845768

North America to boost market growth during the forecast period

Countries such as the US, Canada, and Mexico have been considered in this study. The market in the US is driven by the growing consumer awareness about the importance of protein in the diet, which, in turn, has encouraged the demand for functional food beverages. The versatile functionality of wheat protein has sustained the demand in the baking industry, leading to constant growth in consumption. Research and technological developments in hydrolyzed wheat protein have also led to a long-term consumption trend of wheat protein in the US. However, the increase in discussion on gluten intolerance acts as a hindrance to the growth of the wheat protein market in this region. The high functional profile, low carbon footprint, and low price of wheat-sourced proteins are the key factors encouraging the consumption of wheat protein, particularly in baked products.

The key players in this market include ADM (US), Cargill, Incorporated (US), Tereos (France), Südzucker AG (US), MGP Ingredients (US), Roquette Frères (France), Glico Nutrition Foods Co., Ltd. (Japan), Kerry Group PLC (Ireland), Manildra Group (Australia), Kröner-Stärke (Germany), among others. The study includes an in-depth competitive analysis of these key players in the wheat protein market with their company profiles, recent developments, and key market strategies.